Privacy Policy

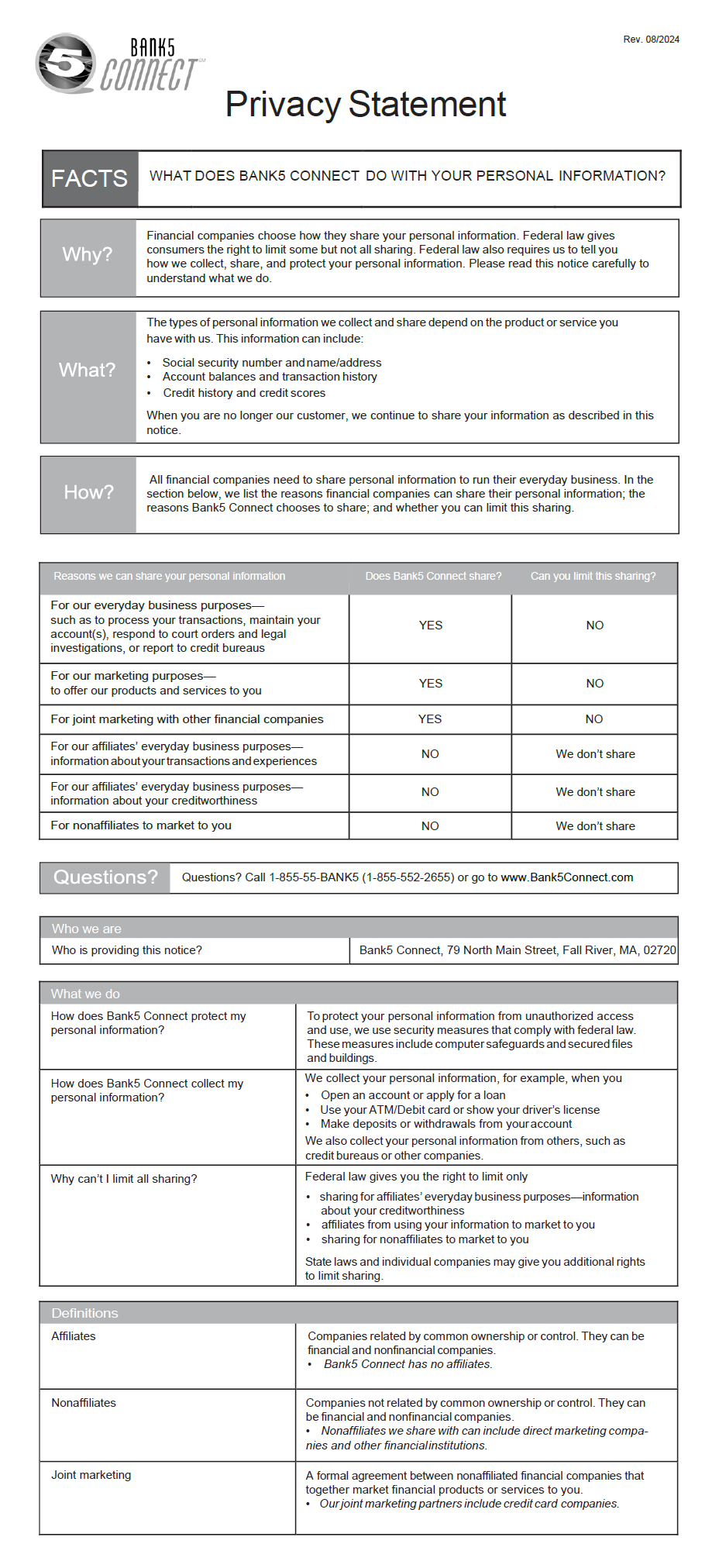

Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do.

Customer Privacy Statement

Online Privacy Policy

California Rights Policy

Bank5 Connect Mobile Privacy Information

Customer Privacy Statement

Revised 8/2024

Click here to download our Privacy Statement

Bank5 Connect Online Privacy Policy

Revised March 2021

We respect and value your privacy and are committed to maintaining your trust and confidence. This policy describes the types of information Bank5 Connect may collect from you or that you may provide when using any online or mobile site or application that we own and control (“Site”), unless a different online and/or mobile or other privacy policy is posted at a particular site, or is made available to you, and by its terms, supplants this policy. This policy also explains how Bank5 Connect collects, uses, maintains, protects, and, in some circumstances, discloses that information.

Simply put, we do not sell users’ personal information. As described more fully below, Bank5 Connect values the information it has about people who access or interact with the Site, and we use this information to enhance the Site and our visitors’ experiences.

Certain information we collect is necessary to complete our contractual or legal obligations, other information is required for us to operate the Site. In some instances, the information we collect may be done only with your consent. In other cases, it may be required by law or regulation.

Federal and state laws give consumers the right to limit some but not all sharing of their information. These laws also require us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do.

By visiting or using the Site or interacting with any of our advertisements displayed through third-party providers, you accept and consent to the data collection, usage, and sharing practices described below and agree to this policy.

We may change this policy from time to time. We encourage you to review this policy each time you visit our Site. By using our Site, you agree to the terms of the most recent version of this policy.

Bank5 Connect is a division of BankFive; this privacy policy does not govern your interactions with the BankFive website. Please click here to review BankFive’s online privacy policy. This policy also does not govern information collected by us offline, through our online banking interfaces, or through any means other than the Site. For more information regarding how we handle the personal information collected via our online interfaces, please review our Customer Privacy Statement, our Internet Banking Disclosures, and privacy information for our Bank5 Connect Mobile online banking app.

INFORMATION YOU GIVE US

When you visit the Site, we collect personal information that you provide to us via online contact forms, applications, surveys, log-in credentials, or other online fields. Examples of the information you may provide to us online include your name, phone number, online banking username and password, address, or social security number.

We’ll refer to this information, and any information that identifies, relates to, describes, references, is reasonably capable of being associated with, or could reasonably be linked, directly or indirectly, with a particular consumer, household, or device, as “personal information.” In some instances, we de-identify data by removing personal information. Once de-identified, the data is no longer attributed to a single unique individual. De-identified information is non-personal information that we may treat like other non-personal information.

If you do not want us to have this information, you can choose not to provide it to us, but then you might not be able to take advantage of many of Bank5 Connect’s services or features.

INFORMATION WE COLLECT AUTOMATICALLY

As you navigate through and interact with the Site, Bank5 Connect may use automatic data collection technologies to collect certain information about your equipment, browsing actions, and patterns, including:

- What pages you visit and what actions you take on our website

- The time and length of your visits to our website

- The addresses of websites and advertisements that brought you to our website

- Keywords used in searches that brought you to our website

- Your browser version, device type, and operating system

- Your Internet Protocol (IP) address and its geolocation

- Your Internet Service Provider (ISP)

We’ll refer to this information as “site-usage information” as it is information collected about your use of and interaction with the Site that does not reveal your specific identity and does not directly relate to an individual.

The information Bank5 Connect automatically collects does not include your name or other directly personal data, but we may maintain it or associate it with personal information we collect in other ways.

FIRST-PARTY COOKIES

Bank5 Connect uses different types of cookies to automatically collect certain data to improve your experience with the Site, and to allow us to track certain information about how visitors use the Site. We do not share or sell any data collected by our cookies. Bank5 Connect uses the following kinds of cookies to enhance your Site experience:

- Cookies (or browser cookies). A cookie is a small file placed on the hard drive of your computer. When you first visit the Site, you are alerted to the fact that we use cookies. You can decline the cookies by activating the appropriate setting on your browser. However, if you select this setting you may be unable to access certain parts of the Site. Unless you have adjusted your browser settings to refuse cookies, the Site will issue cookies when you direct your browser to the Site.

- Flash Cookies. Certain features of the Site may use locally stored objects (or Flash cookies) to collect and store information about your preferences and navigation to, from, and on the Site. Flash cookies are not managed by the same browser settings that are used for browser cookies. If you wish to prevent or restrict Flash cookies, you must do so from within your Adobe Flash Player Settings Manager.

- Web Beacons. Pages of the Site and emails sent by Bank5 Connect may contain small electronic files known as web beacons (also referred to as clear gifs, pixel tags, and single-pixel gifs) that permit Bank5 Connect, for example, to count users who have visited those pages or opened an email, and for other related Site statistics (for example, recording the popularity of certain Site content and verifying system and server integrity).

- Social Media Pixel Tags. Bank5 Connect uses pixel tags, a type of web beacon, on social media sites, to serve relevant and targeted advertisements to you during or after your visits to our social media properties.

To learn more about cookies, please visit the external site http://www.allaboutcookies.org/.

THIRD-PARTY COOKIES

Advertising

We advertise our products and services online through non-affiliated third parties. These advertisements may take the form of banner ads, text-based search ads, social media ads, or other formats. We use information about your location, device, and browsing activities in order to present tailored ads to you, analyze the effectiveness of those ads, and determine whether you might be interested in new products or services.

These third parties may use cookies alone or in conjunction with web beacons or other tracking technologies to collect information about you when you use the Site. The information they collect may be associated with your personal information or they may collect information, including personal information, about your online activities over time and across different websites and other online services. They may use this information to provide you with interest-based (behavioral) advertising or other targeted content.

Bank5 Connect does not control these third parties' tracking technologies or how they may be used. If you have any questions about an advertisement or other targeted content, you should contact the responsible provider directly.

Applications

We also rely on third-party service providers to provide services for us. These other parties may collect information about your web browsing behavior when you use our Site. Through these third-party service providers Bank5 Connect may offer certain widgets or tools on the Site to enhance your online experience. Note that these third-party widgets or tools are sometimes embedded in the Site.

The Site uses functions of Google Analytics and Google Ads, services provided by Google Inc. (“Google”), 1600 Amphitheatre Parkway, Mountain View, CA 94043.

Google Analytics uses first-party cookies to report on visitor interactions on Google Analytics customers’ websites. The information generated by the cookie about your use of this Site (including your IP address) is generally transmitted to and stored by Google servers. This technology allows Bank5 Connect to track and better understand your use of the Site.

The Site also uses the Google Ads platform to advertise on third-party websites (including Google). We may also utilize Google’s remarketing service to deliver ads to previous Site visitors. Through the use of cookies, Google’s remarketing service displays relevant ads tailored to users based on what parts of the Site they have viewed.

To learn more about how Google collects and processes data please click here. To opt-out of having your data be used by Google Analytics, please click here. To stop pop-up ads, or block unwanted Google Ads, please click here.

SOCIAL MEDIA AND USER CONTRIBUTIONS

You may find additional information about our products and services through our social media sites on platforms like Facebook, Instagram, Twitter, YouTube, Trustpilot and LinkedIn. Please keep in mind that any information you share on our social media pages is visible to all, and thus you should never post any sensitive personal information such as account numbers or social security numbers. Please carefully review the Terms of Use and Privacy Policy for each of these individual social media networks, as they may differ from our own policies. Please note that where we have a presence on a site owned by a third party, such as a Facebook page or a listing on Trustpilot, that third party’s privacy policy and terms of use, rather than this policy, will govern, unless specifically stated otherwise.

Some parts of the Site allow you to contribute information to us such as questions, comments, suggestions, ideas, or feedback (“User Contributions”). You acknowledge and agree that any User Contributions provided by you to Bank5 Connect are non-confidential and shall become the sole property of Bank5 Connect. Bank5 Connect shall own exclusive rights, including all intellectual property rights, and shall be entitled to the unrestricted use and dissemination of these User Contributions for any purpose, commercial or otherwise, without acknowledgment or compensation to you.

HOW WE USE YOUR PERSONAL INFORMATION

We may use the personal information you share with us online to follow up on inquiries you send through our Site's contact forms, process loan and deposit account applications you submit to us online, market to you based on your Site usage, ensure technological compatibility with your computer or other electronic or mobile device, improve the customer experience of our Site, conduct aggregate analyses of our Site usage patterns, etc. For more information regarding how we handle the personal information collected via our online interfaces, please review our Customer Privacy Statement, our Internet Banking Disclosures, and privacy information for our Bank5 Connect Mobile online banking app.

Bank5 Connect values the information it has about those who access or interact with the Site and is not in the business of selling that information to others. We do occasionally, however, need to share your information for the purpose of conducting our business with you or to comply with legal obligations. For example, under certain circumstances, Bank5 Connect may need to disclose collected personal information in order to:

- Disclose to trusted third parties, who are bound by contractual obligations to keep personal information confidential, to support our business, and to use it only for the purposes for which we disclose it to them

- Comply with any court order, law, legal process, or to respond to any government or regulatory request, including requests related to laws outside of your country of residence

- Carry out our obligations and enforce our rights arising from any contracts entered into between you and us

- Protect the rights, property, or safety of Bank5 Connect, its employees, customers, or others

- Enforce our terms and conditions

- Permit us to pursue available remedies and/or limit the damages that we sustain

- Fulfill our recordkeeping obligations and practices

- Fulfill any other purpose disclosed by us when you provide the information

- Comply with your instructions or, if allowed to do so, with your consent.

We may also need to provide the collected personal information to a buyer or other successor in the event of a merger, divestiture, restructuring, reorganization, dissolution, or other sale or transfer of some or all of Bank5 Connect’s assets, whether as a going concern or as part of bankruptcy, liquidation, or similar proceeding, in which personal information held by Bank5 Connect about the Site users is among the assets transferred.

HOW WE USE SITE-USAGE INFORMATION

Because your site-usage information does not personally identify you, we and our third-party service providers may use such information for any purpose. Bank5 Connect may also use or disclose aggregated information that does not identify individual users without restriction.

HOW WE PROTECT YOUR INFORMATION

We and our third-party service providers use reasonable organizational, technical and administrative measures to protect the information under our control. To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Unfortunately, no data transmission over the Internet or data storage system can be guaranteed to be 100% secure. Any transmission of personal information is at your own risk.

Please do not send us sensitive information through email. If you have reason to believe that your interaction with us is not secure (for example, if you feel that the security of any account you might have with us has been compromised), you must immediately notify us of the problem by contacting us in accordance with the "Contact Us" section below. (Note that if you choose to notify us via physical mail, this will delay the time it takes for us to respond to the problem.)

WHAT ARE MY CHOICES?

You can always choose not to provide information, even though it might be needed to take advantage of some offers or features of the Site.

You can decline to visit the site, se your browser to block cookies, or erase Bank5 Connect cookies from your computer, though doing so may prevent some aspects of the Site from working properly. As discussed above, third-party cookies may also be active on the Site. If you would like more information about this practice and to learn how to opt out of it on the device on which you are reviewing this Privacy Policy, please visit

https://thenai.org/about-online-advertising/what-are-my-options/ and https://youradchoices.com/.

You can also prevent data collection by Google Analytics by visiting https://tools.google.com/dlpage/gaoptout and downloading Google’s “Google Analytics Opt-Out Browser Add-on”. This browser add-on places an opt-out cookie on your browser, which prevents the future collection of your data by Google Analytics when visiting this (or other) websites. This opt-out cookie must be stored permanently on your computer. If you delete this cookie by removing the add-on, or if it is deleted automatically via browser settings, you will have to install it again before visiting the Site in the future, or your data will be collected by Google Analytics.

If you wish to opt out of having certain Google ads shown to you based on factors such as your interests, previous visits to other websites, and demographic details on your computer’s browser, you can do so by visiting How to Opt Out of Personalized Ads from Google (howtogeek.com).

If you no longer want to receive marketing or promotional email from Bank5 Connect, please press the unsubscribe button at the bottom of our emails, or contact us at marketing@bank5connect.com. Please note that if you are a Bank5 Connect customer we may be required to continue providing certain communications to you, such as those concerning your accounts.

If you want to exercise your rights over your data pursuant to CCPA please see the Bank5 Connect California Rights Policy.

HOW LONG DO WE KEEP YOUR DATA?

Bank5 Connect only keeps your personal data for as long as necessary for the purposes for which we collected it unless a longer retention period is required or permitted by law.

CHILDREN UNDER THE AGE OF 13

The Site is not intended for children under 13 years of age. No one under age 13 may provide any personal information to or on the Site. Bank5 Connect does not knowingly collect personal information from children under 13. If you are under 13, do not use or provide any information on the Site or on/through any of its features, register on the Site, make any purchases through the Site, use any of the interactive or public comment features of the Site, or provide any information about yourself to Bank5 Connect, including your name, address, telephone number, email address, or any screen name or user name you may use. If we learn that we have collected or received personal information from a child under 13 without verification of parental consent, the information will be deleted. If you believe we might have any information from or about a child under 13, please contact us at marketing@bank5connect.com.

YOUR NEVADA PRIVACY RIGHTS

This notice supplements the information contained in our privacy policy and applies solely to all visitors, users, and others who reside in the State of Nevada. Nevada consumers have the right to instruct us not to sell covered information. We do not currently sell covered information of Nevada consumers. In the event we choose to do so in the future, we will update this online privacy policy to provide an opportunity for Nevada consumers to be verified and exercise their opt-out rights under state law.

GDPR

If you are a European Union resident, or are otherwise a data subject covered by the European Union’s General Data Protection Regulation (GDPR) or similar laws in other countries, you may have certain rights in relation to your Personal Information. Such rights may include the right to:

- Request access to your Personal Information (commonly known as a “data subject access request”). This enables you to receive a copy of the Personal Information we hold about you and to check that we are lawfully processing it.

- Request correction of the Personal Information that we hold about you. This enables you to have any incomplete or inaccurate data we hold about you corrected, though we may need to verify the accuracy of the new data you provide to us.

- Request erasure of your Personal Information. This enables you to ask us to delete or remove Personal Information where there is no good reason for us continuing to process it. You may also have the right to ask us to delete or remove your Personal Information where you have successfully exercised your right to object to processing (see below), where we may have processed your information unlawfully or where we are required to erase your Personal Information to comply with local law. Note, however, that we may not always be able to comply with your request of erasure for specific legal reasons which will be notified to you, if applicable, at the time of your request.

- Object to processing of your Personal Information where we are relying on a legitimate interest (or those of a third party) and there is something about your particular situation which makes you want to object to processing on this ground as you feel it impacts on your fundamental rights and freedoms. You also may have the right to object where we are processing your Personal Information for direct marketing purposes. In some cases, we may demonstrate that we have compelling legitimate grounds to process your information which override your rights and freedoms.

- Request restriction of processing of your Personal Information. This enables you to ask us to suspend the processing of your Personal Information in the following scenarios: (a) if you want us to establish the data’s accuracy; (b) where our use of the data is unlawful but you do not want us to erase it; (c) where you need us to hold the data even if we no longer require it as you need it to establish, exercise or defend legal claims; or (d) you have objected to our use of your data but we need to verify whether we have overriding legitimate grounds to use it.

- Request the transfer of your Personal Information to you or to a third party. This enables you, or a third party you have chosen, to seek to have your Personal Information provided in a structured, commonly used, machine-readable format. Note that this right only applies to automated information which you initially provided consent for us to use or where we used the information to perform a contract with you.

- Withdraw consent at any time where we are relying on consent to process your Personal Information. However, this will not affect the lawfulness of any processing carried out before you withdraw your consent. If you withdraw your consent, we may not be able to provide certain products or services to you. We will advise you if this is the case at the time you withdraw your consent.

You will not have to pay a fee to exercise any of these rights. However, we may charge a reasonable fee if your request is repetitive or excessive. Alternatively, we may refuse to comply with your request in these circumstances.

We try to respond to all legitimate requests in a timely manner. Occasionally it may take us longer if your request is particularly complex or you have made a number of requests. In this case, we will notify you and keep you updated. We may also need to contact you about your request to verify your identity, confirm certain information, or clarify the request before we can fulfill the request. If you have an account with us and access to our Online Banking portal, we will deliver our written response to that secure account. If you do not have an Online Banking account with us or do not have access to our Online Banking portal, we will deliver our written response by mail or electronically, at your option.

If you are a European Union resident, or are otherwise a data subject covered by GDPR or a similar law and would like to exercise these rights or otherwise have questions about your rights please contact us using one of the following methods:

Email: marketing@bank5connect.com

Phone: 1 (855) 55-BANK5

Postal Mail:

Data Protection, Marketing

Bank5 Connect

79 North Main Street

Fall River, MA 02720

CHANGES TO OUR PRIVACY POLICY

It is Bank5 Connect’s policy to post any changes it makes to its privacy policy on this page with a notice that the privacy policy has been updated on the Site home page. If Bank5 Connect makes material changes to how it treats its users' personal information, we will notify you by email at the primary email address specified in your account and/or through a notice on the Site home page. The date the privacy policy was last revised is identified at the top of this page. You are responsible for ensuring that we have an up-to-date, active, and deliverable email address for you, and for periodically visiting the Site and this privacy policy to check for any changes.

HOW CAN I CONTACT YOU?

To ask questions or comment about this privacy policy and Bank5 Connect’s privacy practices, contact us via one of the following methods:

Email: marketing@bank5connect.com

Phone: 1 (855) 55-BANK5

Postal Mail:

Data Protection, Marketing

Bank5 Connect

79 North Main Street

Fall River, MA 02720

Bank5 Connect California Rights Policy

YOUR CALIFORNIA PRIVACY RIGHTS

This notice supplements the information contained in our Online Privacy Policy and applies solely to all visitors, users, and others who reside in the State of California (”consumers” or “you”). We adopt this notice to comply with the California Consumer Privacy Act of 2018 (“CCPA”) and other California privacy laws. Any terms defined in the CCPA have the same meaning when used in this section.

Pursuant to CCPA we are providing the following details regarding the categories of personal information about California residents that we have collected (whether online or offline) or disclosed within the preceding 12 months. We may not collect and/or share all of the information listed below from you. What we collect and/or share depends on your relationship with us.

| Category | Examples | Collected |

| A. Identifiers. | A real name, alias, postal address, unique personal identifier, online identifier, Internet Protocol address, email address, account name, Social Security number, driver's license number, passport number, or other similar identifiers. | Yes |

| B. Personal information categories listed in the California Customer Records statute (Cal. Civ. Code § 1798.80(e)). | A name, signature, Social Security number, address, telephone number, passport number, driver's license or state identification card number, employment, employment history, bank account number, credit card number, debit card number, or any other financial information, Some personal information included in this category may overlap with other categories. | Yes |

| Physical characteristics or description, insurance policy number, education, medical information, or health insurance information. | No | |

| C. Protected classification characteristics under California or federal law. | Age (40 years or older), race, color, ancestry, national origin, citizenship, marital status, sex (including gender), veteran or military status. | Yes |

| Religion or creed, medical condition, physical or mental disability, information related to pregnancy, childbirth, or related medical conditions, sexual orientation, gender identity, gender expression, genetic information (including familial genetic information). | No | |

| D. Commercial information. | Records of personal property, products or services purchased, obtained, or considered, or other purchasing or consuming histories or tendencies. | Yes |

| E. Biometric information. | Genetic, physiological, behavioral, and biological characteristics, or activity patterns used to extract a template or other identifier or identifying information, such as, fingerprints, faceprints, and voiceprints, iris or retina scans, keystroke, gait, or other physical patterns, and sleep, health, or exercise data. | No |

| F. Internet or other similar network activity. | Browsing history, search history, information on a consumer's interaction with a Site, application, or advertisement. | Yes |

| G. Geolocation data. | Physical location or movements. | Yes |

| H. Sensory data. | Audio, electronic, visual, thermal, olfactory, or similar information. | No |

| I. Professional or employment-related information. | Current or past job history. | Yes |

| Performance evaluations. | No | |

| J. Non-public education information (per the Family Educational Rights and Privacy Act (20 U.S.C. Section 1232g, 34 C.F.R. Part 99)). | Education records directly related to a student maintained by an educational institution or party acting on its behalf, such as grades, transcripts, class lists, student schedules, student identification codes, student financial information, or student disciplinary records. | No |

| K. Inferences drawn from other personal information. | Profile reflecting a person's preferences, characteristics, psychological trends, predispositions, behavior, attitudes, intelligence, abilities, and aptitudes. | No |

We may disclose your personal information for a business purpose to the following categories of third parties:

- Our affiliates, subsidiaries and affiliated brands.

- Service providers.

- Third parties to whom you or your agents authorize us to disclose your personal information in connection with products or services we provide to you.

In the preceding twelve (12) months, we have not sold any personal information for a third party’s commercial purpose or for monetary value.

California residents have the right to opt out of the sale of their information by businesses that sell personal information. The CCPA defines a “sale” as the disclosure of personal information for monetary or other valuable consideration. Bank5 Connect does not offer an opt out from the sale of personal information because we do not and have not within at least the last 12 months sold personal information. The CCPA also requires that we state that we have no actual knowledge that we have sold personal information of California residents 15 years of age and younger.

Your Rights and Choices

The CCPA provides consumers (California residents) with specific rights regarding their personal information. This section describes your CCPA rights and explains how to exercise those rights.

Access to Specific Information and Data Portability Rights

You have the right to request that we disclose certain information to you about our collection and use of your personal information over the past 12 months. Once we receive and confirm your verifiable consumer request we will disclose to you:

- The categories of personal information we collected about you.

- The categories of sources for the personal information we collected about you.

- Our business or commercial purpose for collecting or selling that personal information.

- The categories of third parties with whom we share that personal information.

- The specific pieces of personal information we collected about you (also called a data portability request).

- If we sold or disclosed your personal information for a business purpose, two separate lists disclosing:

- sales, identifying the personal information categories that each category of recipient purchased; and

- disclosures for a business purpose, identifying the personal information categories that each category of recipient obtained.

Deletion Request Rights

You have the right to request that we delete any of your personal information that we collected from you and retained, subject to certain exceptions. Once we receive and confirm your verifiable consumer request we will delete (and direct our service providers to delete) your personal information from our records, unless an exception applies.

We may deny your deletion request if retaining the information is necessary for us or our service provider(s) to:

- Complete the transaction for which we collected the personal information, provide a good or service that you requested, take actions reasonably anticipated within the context of our ongoing business relationship with you, fulfill the terms of a written warranty or product recall conducted in accordance with federal law, or otherwise perform our contract with you.

- Detect security incidents, protect against malicious, deceptive, fraudulent, or illegal activity, or prosecute those responsible for such activities.

- Debug products to identify and repair errors that impair existing intended functionality.

- Exercise free speech, ensure the right of another consumer to exercise their free speech rights, or exercise another right provided for by law.

- Comply with the California Electronic Communications Privacy Act (Cal. Penal Code § 1546 et. seq.).

- Engage in public or peer-reviewed scientific, historical, or statistical research in the public interest that adheres to all other applicable ethics and privacy laws, when the information's deletion may likely render impossible or seriously impair the research's achievement, if you previously provided informed consent.

- Enable solely internal uses that are reasonably aligned with consumer expectations based on your relationship with us.

- Comply with a legal obligation.

- Make other internal and lawful uses of that information that are compatible with the context in which you provided it.

To exercise the access, data portability, and deletion rights described above, please submit a verifiable consumer request through our CCPA Request Form. Alternatively, you may submit a verifiable consumer request by phone if you so choose. You may do so by calling us toll-free at 1 (855) 55-BANK5.

Only you, or someone legally authorized to act on your behalf, may make a verifiable consumer request related to your personal information. You may also make a verifiable consumer request on behalf of your minor child.

You may only make a verifiable consumer request for access or data portability twice within a 12-month period. The verifiable consumer request must:

- Provide sufficient information that allows us to reasonably verify you are the person about whom we collected personal information or an authorized representative, which may include: your account number, driver’s license number, mother’s maiden name, last four digits of your social security number mailing address, zip code

- Describe your request with sufficient detail that allows us to properly understand, evaluate, and respond to it.

We cannot respond to your request or provide you with personal information if we cannot verify your identity or authority to make the request and confirm that the personal information relates to you. Making a verifiable consumer request does not require you to create an account with us. We will only use personal information provided in a verifiable consumer request to verify the requestor's identity or authority to make the request.

Response Timing and Format

We endeavor to respond to a verifiable consumer request within forty-five (45) days of its receipt. If we require more time (up to 90 days), we will inform you of the reason and extension period in writing. If you have an account with us and access to our online portal, we will deliver our written response to that account. If you do not have an account with us or do not have access to our online portal, we will deliver our written response by mail or electronically, at your option. Any disclosures we provide will only cover the 12-month period preceding the verifiable consumer request's receipt. The response we provide will also explain the reasons we cannot comply with a request, if applicable. For data portability requests, we will select a format to provide your personal information that is readily useable and should allow you to transmit the information from one entity to another entity without hindrance.

We do not charge a fee to process or respond to your verifiable consumer request unless it is excessive, repetitive, or manifestly unfounded. If we determine that the request warrants a fee, we will tell you why we made that decision and provide you with a cost estimate before completing your request.

Non-Discrimination

You have the right to be free from unlawful discrimination by a business for exercising your rights under the CCPA.

California’s “Shine the Light” Law

California law permits customers in California to request certain details about how their personal information is shared with third parties and, in some cases, affiliates, if the personal information is shared for those third parties’ and affiliates’ own direct marketing purposes. We do not share personal information with third parties or affiliates for those third parties’ or affiliates’ own direct marketing purposes. Californians may request and obtain from us once a year, free of charge, information about the personal information (if any) that we disclosed to third parties for direct marketing purposes in the preceding calendar year.

To make a request, please provide sufficient information for us to determine if this applies to you, attest to the fact that you are a California resident, and provide your current California address to which we will send our response. Your inquiry must specify “California Shine the Light Privacy Rights Request” in the subject line of the email or the first line of the letter, and include your name, street address, city, state, and ZIP code. Please note that we are only required to respond to one request per customer each year.

Changes to our privacy policy

We reserve the right to amend this privacy notice at our discretion and at any time. When we make changes to this privacy notice, we will post the updated notice on the Site and update the notice's effective date. Your continued use of our Site following the posting of changes constitutes your acceptance of such changes.

Bank5 Connect Mobile Privacy Information

BANK5 CONNECT MOBILE

Bank5 Connect customers have the option of downloading the Bank5 Connect Mobile application (“app”) from the App Store or Google Play Store to conduct mobile banking activities. Information collected through the Bank5 Connect Mobile app includes banking transaction information and information about your mobile activity, such as when the app is opened or exited, and which pages within the app are visited. If Location Services are enabled, the Bank5 Connect Mobile app will also collect geolocation data which is used to send targeted push notifications, in-app advertisements and alerts. Please note that if Location Services are enabled, the Bank5 Connect Mobile app will collect this location data even when the app is closed or not in use. You may disable the app’s collection of geolocation data at any time by disabling Location Services for the app on your mobile device(s).

Deleting Your Account

The Bank5 Connect Mobile app allows you to conveniently access your Online Banking account through your mobile device. If at any time you wish for us to delete your Online Banking account, you can send us an account deletion request.

Please be aware that once your Online Banking account has been deleted, you will no longer be able to log into Online Banking via our mobile app, or through the Online Banking link on our website. Once we receive your account deletion request, we will reach out to you to confirm your identity. Please allow 1-2 business days for us to contact you regarding your request. It's important to note that we can only delete your account once we have validated your identity, and the deletion request. Once we have validated you and the request, we will delete your Online Banking account within 1-2 days and will confirm with you once it has been deleted.

Prior to requesting deletion of your Online Banking account, we recommend that you log into your Online Banking account and download copies of your eStatements prior to account deletion. Please note that deleting your Online Banking account will prevent you from receiving eStatements in the future, and that some Bank5 Connect accounts have a Paper Statement Fee. Please refer to your Account Disclosures to understand which fees apply to your account(s).

If you wish to request deletion of your Online Banking account, you can do so in any of the following ways:

- Call us at 855-552-2655

- Email us at customerservice@bank5connect.com

- Log into your Online Banking account and send us a Secure Mail from within Online Banking (this is the preferred method, as it speeds up the identity verification process)

Questions? Browse our FAQs to learn more.